New payment solution at Samfunnet

New payment solution at Samfunnet!

Where were you when DiggiPay Cashless bank terminals cash was trashed?

Photojournalist: Tord Kristian F. Andersen

Photographer: William Fredrik Bakke Dahl

Translator: Natalie Nazareno

Web-distributør: Martha Ingeborg Evensen

Late autumn 2023, it was made clear that Samfunnet and UKA I Ås’ supplier of payment services, Espos, no longer wanted to renew their current agreement with today’s terms. A tenacious hunt was thus started to ensure a new payment solution before the students returned for their January block; today it is possible to pay with ordinary bank cards through Zettle from PayPal, the latest in a long row of payment solutions.

The 17th of November 2023, KS Bank for UKA i Ås, Ezizgol Rezai, met with Espos to negotiate a new agreement for UKA 2024. It was in this meeting that Espos, supplier of the payment solution DiggiPay, made it clear that they no longer wished to renew the agreements with the current terms. Ezizgol tells that the kind price “was taken for granted”, with good terms due to the mobile terminals which were part of a three year long pilot program.

After the meeting, it was clarified in an email thread that the termination would also include Samfunnet. Thus, over a short time period, we would lose the 16 terminals and be left with no payment solutions when the students returned from their Christmas holiday.

Håkon Kvernstuen, Head of Finance at Samfunnet, and Magnus Aalde, Head of Finance for UKA i Ås, can tell us about the busy days after receiving the news. “There was a crisis meeting with UKA and Samfunnet, where we agreed to go our separate ways and see what we could find.” As a respons to this, there was also an urgent meeting with the Board of House and Finance, the advisory and financial governing body at Studentsamfunnet. Håkon tells that the Board of House and Finance was as shocked as the two Heads of Finance, but that they remained calm: “They were probably a bit more in the mindset that everything would be okay”

With the Board of House and Finance’ full support, and armed with a month to find and sign a new agreement, they went to work. Normally, these larger investments take a long time to settle with several offer rounds, but in this case all parties were set on finding something, fast. Finally, they found the solution Zettle by PayPal, which makes it possible to pay with normal bank cards. This is also a better solution for international students, since DiggiPay required a Norwegian bank account and Vipps to refill your card. Although the transition to a new payment solution wasn’t planned well in advance, a new solution was quickly found and implemented smoothly

Håkon asked the question you may be wondering yourself: “Why didn’t we start earlier?” One of the reasons is that Zettle is a very new system. Magnus would also like to emphasise that, until now, Espos has been very helpful with any problems, it has been cheap, and in return Samfunnet has acted as a test lab.

This is by no means the first time a payment solution has been changed at Samfunnet. Until 2019, the Cashless service was used. This solution was also provided by Espos, and is very similar to its successor, DiggiPay. The difference is that you had to top up money at special terminals, either with cash or later by card. Cashless as a solution was first tried during UKA i Ås 2010, and in January 2012 Samfunnet also started using it. Before this, cash was mainly used, with some use of bank terminals during UKA and larger events.

Håkon Johansen was the Leader of Samfunnet from autumn 2011 to spring 2012 and says that the reason for switching to Cashless was largely due to cards not working well in practice. He also tells us that he was somewhat worried about robberies: “There was an awful lot of cash in circulation!” After each event, the cash was counted, and the event manager had to bring money of up to several hundred thousand after the largest events to the safe in the center of Ås. “Someone who knew about this could bring a knife and leave with a lot of money”, says the former leader thoughtfully. A specific incident is mentioned, where a volunteer snuck away larger sums of cash. Storied of people ordering beer, then cancelling the payment and running away before they could be caught are also mentioned. This was without a doubt built as a trust based Samfunn.

Kaja Heltorp was Head of Administration for UKA in 2008, and echoes Håkon’s statements. Nevertheless, she believes that Håkon was probably more worried than she was.

Kaja is from Skjeberg and “hadn’t heard of crime”. She continues to talk about bank volunteers who ran around with notes to ensure that the terminals always had enough cash to exchange without being too full, and that the ATM had cash to withdraw. “A nice job if you wanted to steal”, she laughs over the phone.

Kaja says that there was great resistance against transitioning to Cashless in the beginning, partly because of the costs of getting av card. Even so, she sees it as a necessary change. “Cash is actually a bloody bad idea”, chuckles Kaja, when she thinks back to how they were doing things. At this time, there was a booth with a staffed ATM in the Bodega entrance. Kaja clearly remembers that it was stated in the event instructions that the people doing community service there should not be “airheaded”. In other words, it should be someone organized that could be trusted.

What really took time before Cashless was the counting of cash. Hanna Fuglseth, who was the Head of Finance at Samfunnet in 2007, remembers that there were always two people who counted the money in the Samfunnet-office (now the NU-office) after the event was done. It was usually people from the Bodega Consolidation on Wednesdays and the Board of Samfunnet on Fridays who counted the money. There was some limited use of bank terminals, at larger events and during UKA. She recalls that the terminals were expensive, and that you had to have a subscription from the dealer.

When Hanna was in the Board of Samfunnet, she also sat in the Board of House and Finance with, among others, Knut Damm Lyngstad. He was also Head of Finance at Samfunnet, albeit in 2001. He confirms the beforementioned and remembers that only cash was used when he started studying in 1997. “When Klubben was established, they got bank terminals, and these were borrowed to the Bodega during event nights”. Knut says that during his time, they sold for NOK 3-400,000 at large events and during UKA. This was moved around in money boxes, which has plastic dividers to separate the different types of money. During the busiest evenings, these plastic dividers were thrown out and the money stuffed in to make room for everything. It was difficult to balance so that there was always enough cash. If many people wanted to use the ATM, there had to be enough in the safes, but not at the expense of storing an unnecessary and unsafe amount of cash.

In other words, problems with payment solutions during events are not a new phenomenon. In hindsight, Jan Ove Holmen, who was the UKEleader in 1970, is surprised that they were able to communicate so well when “everything was manual!” Even the ticket systems have become easier. Before, there was a separate Head of Tickets in the Board of UKA in addition to the Head of Finance, due to the large amount of work required.

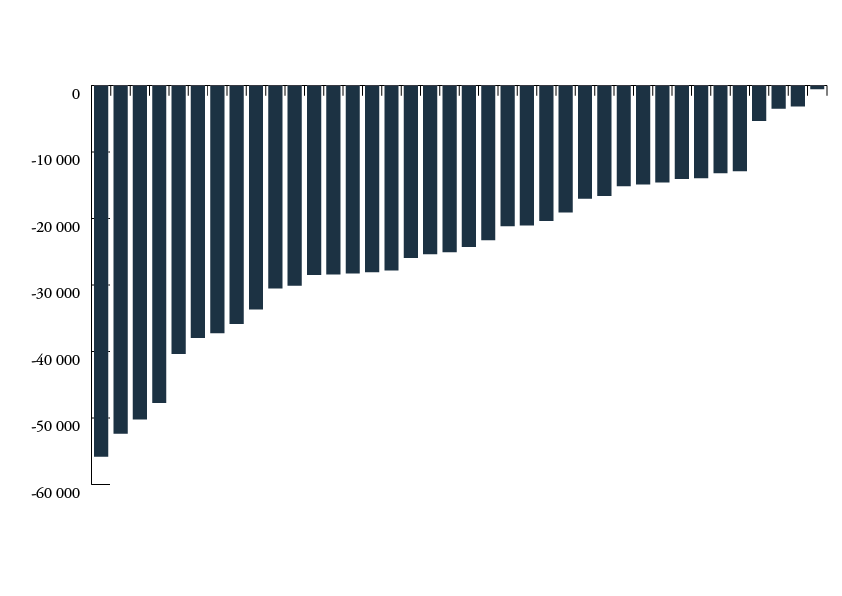

Woops, I lost the thread there… What were we talking about? Oh yeah! DiggiPay which is trashed! One thing that has remained unsaid is that DiggiPay is unique in how easy it is to see how much you have topped up and spent on your user. For the occasion, an information competition was created on Facebook to see who has spent the most in the four years of DiggiPay being used at Studentsamfunnet. Here are the preliminary results:

Each bar here represents an individual, where the sum represents all purchases made by the user. N = 38, so it is not a given how well this represents the entire s t u d e n t population, however, it may give an indication of the purchase pattern. The average is NOK -24,795.46, with a similar median of NOK -24,639.00. With that said, one must remember that one of the years this applied to was 2020, with limited operations at Samfunnet.

From the graph, you can see that there is a preponderance of people with contributions over NOK 40,000. However, I do suspect that those who have financed Samfunnet with this amount are a little extra proud of their contribution and want to make it known. Or maybe students simply are drunkards. Possibly even more now that it will be easier to pay, but only time can tell.

The switch to Zettle has been almost problem-free, and the current Head of Finance at Samfunnet, Håkon, wishes to give the volunteers some recognition. “I want to brag about those who have been at work, they have really jumped straight into it”. Magnus echoes. “There have been no comments about, oh, new system.” Much of the reason for this may have to do with not having to switch to a new system on the consumer side either. Now, ordinary bank cards are to be used.

Now that you’ve become an expert on how the payment system at Samfunnet works, you just have to go out and try it, right? Or maybe that counts as an alcohol advertisement, @norwegiangovernment?